I can't believe December is here already and the Christmas shopping season is in full force! This time of year it seems as if there are so many things going on and spending that occurs that things have the potential to get out of control pretty fast in the budget department.

Guilty.

And you know what? Sometimes in the past it wasn't so much a problem with what and how much I spent, but more so the fees that added up. When life gets super busy its easy to miss a due date or get charged a late fee or finance charge. I know it seems silly, but please tell me that I'm not the only one that has struggled with this before?

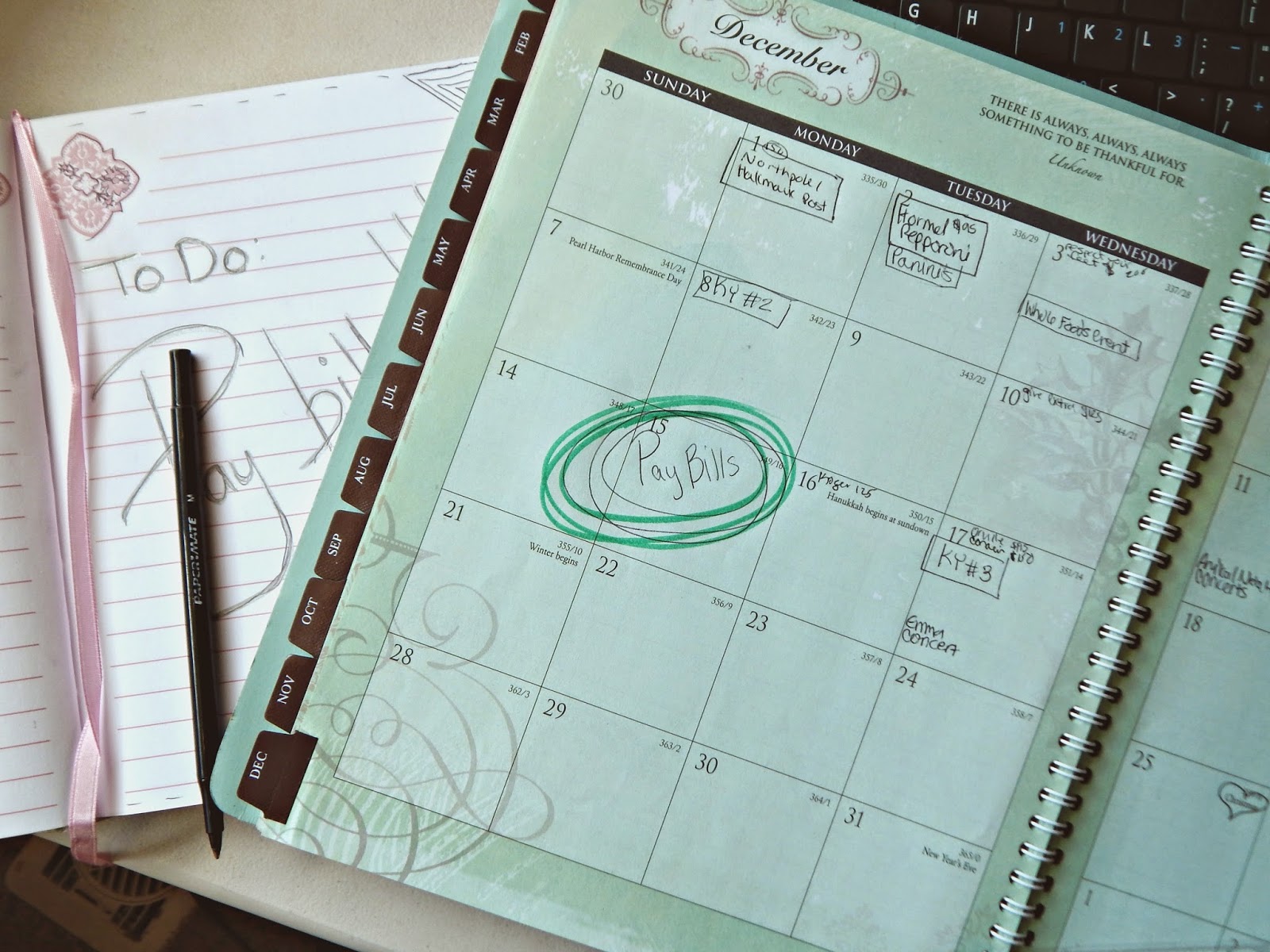

I know the easiest way to have more money is to know where its going and how and when its getting there, so I'm making an (early!) New Year's resolution to set aside a specific "bill paying date night" with myself (and my husband) every month.

This set evening is a night I plan on making a routine, to ensure that nothing gets missed or forgotten.

On this night we'll:

1. Go over the months income // when and how much we're getting paid since ours varies monthly

2. Update our bill spreadsheet // I actually just use a blank printed version and hand write it in each month - maybe someday I'll go high tech. :)

3. Figure out the extras // things like road trips, school activities, play money - whatever isn't a set bill needs to be gone over with each month and discussed.

4. Reward myself // face it - it's not always fun to sit down after a long day and do more...work. So, why not reward myself after I'm done by a special cocktail or a fancy dessert for two? Just something little that I can look forward to when the "bill paying date night" is over.

4. Reward myself // face it - it's not always fun to sit down after a long day and do more...work. So, why not reward myself after I'm done by a special cocktail or a fancy dessert for two? Just something little that I can look forward to when the "bill paying date night" is over.

I've also been looking online for more inspiration for keeping myself motivated and organized and I've found a few neat sites like this one from Capital One. They are having some sweet Black Friday Sales that can help with financial goals like new account bonuses and other deals!

Black Friday Deals:

| Product | Offer | Details |

| ShareBuilder | Up to $1,250 bonus (tiered offer) |

|

| Home Loans | $1,250 off closing costs |

|

| 360 Checking | $100 bonus |

|

| 360 Savings | $100 bonus |

|

| Refer a Friend | $40 bonus per successful referral |

|

Hopefully I'll be a little bit close to #FinancialPeace when I get the schedule down better! What do you do every month to stay organized and on top of finances?

~Melissa

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.